3d secure is a new generation bank payment protection technology using a secure encryption algorithm. In fact, it is an XML protocol for an additional level of security for online payments by credit and debit cards on the site. It was first introduced by such a large payment system as Visa. Often on large Internet sites you can find the logo " Verified by Visa". Later, such major players as American Express, MasterCard, Union Pay, etc. joined this technology. Let's look at what 3d Secure technology is for, how much it costs, and how to connect it for payments in Sberbank.

3-d secure two-factor authentication - an overview

As described above, this is a security protocol for online shopping with online cards. This mechanism is implemented by exchanging data between 4 communication nodes. On the one hand, the client, the cardholder, on the second, the seller of a product or service, on the third, the issuer (Visa or MasterCard), on the fourth, the acquirer is the bank serving the seller. Previously, when buying online with a card, it was not necessary to physically possess it, i.e. the owner could forget her at home. For a successful purchase, it was enough to enter the data (card number and expiration date, CVC or CVV2 code, full name, password. In fact, an attacker, knowing this data, could steal funds. Now, to access your finances, you need another phone.

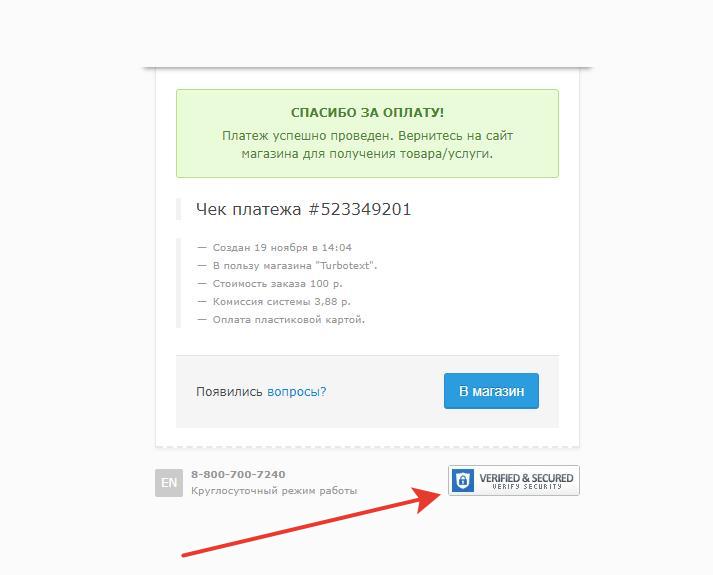

With the introduction of technology in Sberbank 3d Secure for Visa or secure code for MasterCard, online shopping becomes even more secure. After entering all personal data on the seller's website, there is a redirect to the Sberbank website. At the same time, the 3d-Secure password is sent to the cardholder's phone. In case of successful and timely entry of this password, you are automatically returned to the seller's website and the transaction is approved by the bank and the payment system. Security also lies in the fact that Sberbank employees themselves do not know this 3d secure code. This 6-digit password is generated by the server and has a certain lifetime, after which it becomes invalid.

How to find out if 3d secure technology is connected or not

At the moment, by default, Sberbank connects all its customers, holders of credit and debit cards, to 3d secure password protection via SMS. This is done to provide increased security when making purchases online. A couple of years ago, you could connect to this two-factor authentication by writing a corresponding application.

Now, when mobile banking is disabled, the 3d secure function is not available. On the web, you can often find mentions that, in order to receive one-time passwords for payment, you can request them at an ATM by printing a check. To date, this service is no longer available to users. The only optimal option is to connect a mobile bank (full or economical package). The only difference between the economical package is that after payment, there will be no confirmation from the Savings Bank by SMS message.

We connect the full package of mobile banking by phone

- We enter the word "Full" in an SMS message on the phone tied to the card;

- Sending a message to a number 900 ;

- In response, you will receive an SMS with the content “To change the tariff plan to “Full” for cards “VISA ####”, send the code “#####”.

- Enter this code from SMS;

- We receive a response SMS with confirmation of the connected service.

Now, when making a payment on the seller's website, secure SMS passwords should come.

Service 3d secure for customers it is completely free, but for Sberbank this mechanism is quite expensive. A lot of money is invested in ensuring the safety of their customers.

How to pay for a product or service: detailed instructions

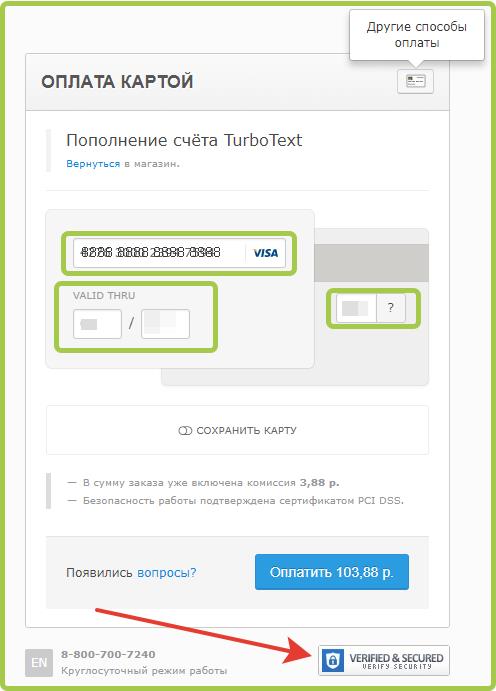

To pay using 3d-secure you need:

- the presence of a card;

- the seller's website must be connected to the system " Verified by Visa» and/or « MasterCard SecureCode «.

- mobile banking must be active;

- the presence of a phone tied to the card.

So, we go to the seller's website, where we need to make a payment.

Attention!

If the "Mobile Bank" service is not activated, the "Verified by Visa" authentication method is not available, and the payment may be refused.

Is it possible to disable 3d-secure

Sberbank, like many other large banks, does not allow you to turn off the service of increased protection of funds when paying. It is connected by default to the cardholder. But there are still many sites on the network without 3ds, so you won't receive a security code. Imagine a situation when you make a purchase on the Internet, you only need to enter your card details, amount and password. A fraudster, knowing all this data, will also not be difficult to use them and make a purchase on the Internet or make a transfer. From the point of view of responsibility, the bank in this case fulfilled its obligations to the client. This means that it will be very problematic to return the stolen funds from the Sberbank card.

Are payments 100% secure with two-factor protection?

Of course not. there can be no guarantees here. Technology does not stand still, and users do not always pay due attention to safety when shopping. Passwords and access to mobile may be lost. Also, data can be intercepted over the network. To this end, Sberbank has developed some recommendations to reduce the risk of losing personal finances.

- The client needs to keep his personal information secret;

- Do not save passwords, credit card numbers on websites when buying;

- It is advisable to set limits on debit transactions in Sberbank online;

- The phone tied to the card must also be kept in a safe place, once again do not transmit the number in messages and on websites;

- Enable phone auto-lock;

- It is advisable to frequently change the pin code for the card and for the personal account of Sberbank Online”;

- When personal data is compromised, it is necessary to block a credit card, change passwords, call the Sberbank support service for security advice.