February 3, 2014

If you don't budget, you're essentially inviting unnecessary debt and depriving yourself of the ability to save. These steps will help you learn how to budget and control your spending.

✔ Track income and expenses

1. Determine your total income. Do you have a fixed salary and know how much you bring home each month? Are you a freelancer and the salary varies from month to month? A clear idea of how much you will earn is the most important thing for creating a successful budget.

2. Determine how you spend money. What bills do you need to pay each month? Do you go out with friends for dinner every Friday or do you go to the cinema once a week? Knowing where the money goes will help you keep track of it better.

3. Add up regular expenses and subtract them from your salary. Is it a negative number? If so, you are clearly living beyond your means. If money remains, divide it into several groups:

Flexible money. About 10-20% of the difference between salary and regular expenses should be ready in case you suddenly have to pay more than expected for something. This can happen to utility bills if gas prices suddenly go up, if you have a flat tire or something.

Saving. Ideally, you should save 30% of your salary, although even 10% (if you do it all the time) is not bad. Set aside money for an emergency fund (4-6 times your monthly expenses), then start saving for investing.

Expenditure money is what is left after savings and flexible money are deducted. This is the money you spend on clothes, eating out, and other entertainment.

✔ Create a budget

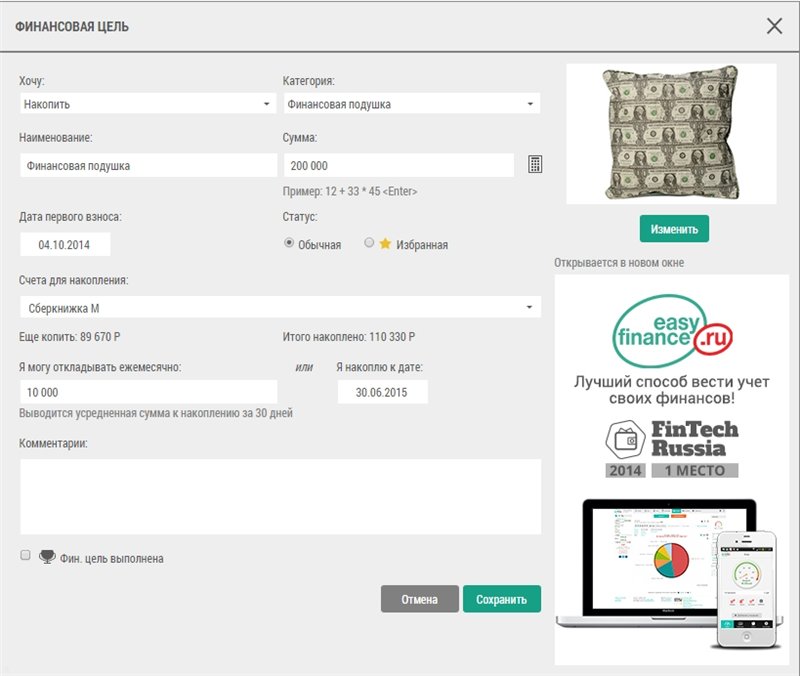

1. Set budget and financial targets. They should be both short and long term. The former include not spending more than a certain amount each month, or saving a certain amount each month. The second includes: the ability to make a down payment on a car or house. You need some kind of goal to help you stick to your budget. It is convenient to set financial goals using the service. You can specify the date you want to save for a trip or creating a financial cushion (in the amount of 6-12 monthly salaries), and the server will automatically calculate the amount that you need to set aside each month.

2. Make a list of everything you need to pay for. This includes the most important - rent, electricity, heating. Let these expenses be the most important in the budget.

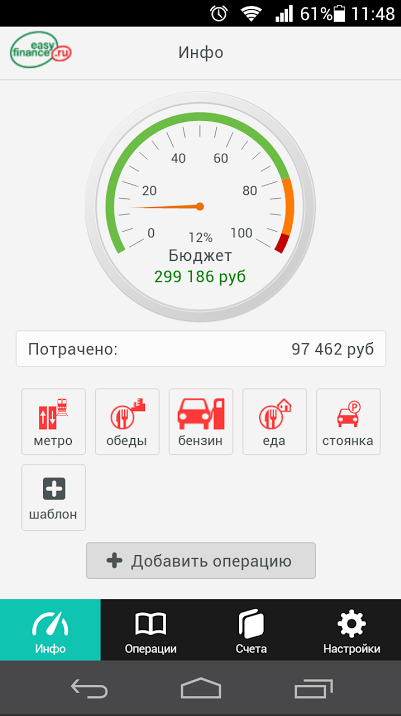

3. Use the software. Android Application

“Personal Finance. Family budget " from

has built-in tools for working with the budget.

✔ Budget maintenance

1. Don't go over budget. Sounds obvious, but going out of budget is easy even when you have one. Spend money wisely..

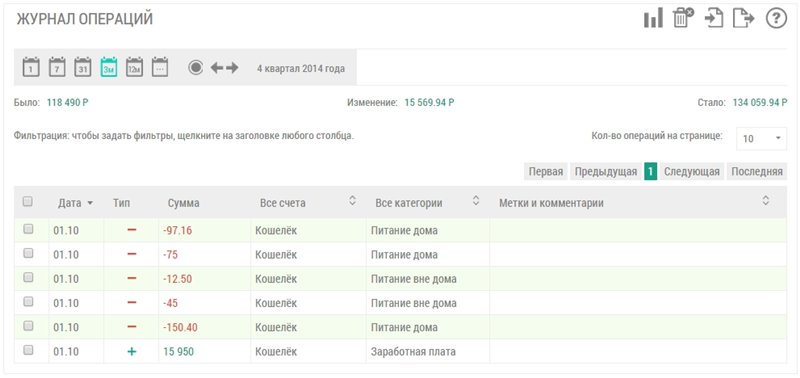

2. Make daily payments and income to the site. Keep track of recurring expenses that can be easily avoided. For example, a daily trip to a cafe to drink coffee.

3. Don't expect to receive money unexpectedly. Do not take into account potential sources of income such as a New Year's bonus or a tax refund. In the budget, you should include only the money that you receive absolutely exactly.

4. Leave your debit/credit card at home. Once you've got somewhere, it's very easy (and tempting) to splurge heavily. Do not do this!

5. Save money for the whole week at once. If you want to spend 8000 every week and no more, go to an ATM on Monday and withdraw all the money at once. Run out of money? All.

✔ More ways to stick to a budget

1. Consider the difference between luxury and necessity. Determine what is “needed” and what is “want” in your budget. Let the needs are in your budget at the forefront, and if there is money left, allow yourself to get out somewhere or go shopping.

2. Cut big expenses. This is the most efficient way to stay within budget. If you go somewhere on vacation every year, consider staying at home this year. If you smoke, think about how you can quit.

3. Pay less taxes. If you file your tax return once a year, try using itemized deductions instead.

4. Stay one step ahead of inflation. Over time, inflation increases the cost of living. A 3% annual growth would double the value of everything in 24 years. If your income is rising, don't splurge on luxuries until you're sure you can stay one step ahead of inflation all the time.

Sample Budget

Salary: 60000 r.

Regular expenses:

Rent 18000 R.

Mobile 1000 rub.

Food 8000 rub.

Utility payments 5000 rubles.

Machine 5000

Gasoline 3000

Total - 60000

60000 - 40000 (recurring expenses) = 20000

20000 - 6000 ("flexible" money, 10% of salary - regular expenses) = 14000

14000 - 3000 (savings, 5% salary) = 11000

11000 - the money with which you can do whatever you want until the next paycheck.